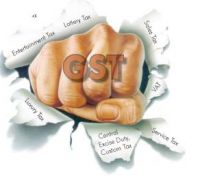

The Lok Sabha has passed GST Bill, and thus bringing a unified indirect tax system in India. New tax system will integrate the existing major indirect taxes of the centre and states including – Union Excise Duties, Service Taxes, and state Sales Tax.

GST will be a totally different fiscal experience for the states. This is because the sales tax, which is an important component of the GST, is the largest tax revenue for the states. Introduction of GST in this respect is a major event for the states. On the other hand, the GST is not touching the Union excise duties is the third and fourth largest tax resources for the centre. State will have only restricted power to change the tax rate under Stage Goods and Service Tax.

The new GST will have a cumulative rate of around 27 % for most of the goods and IT can be considered as a standard rate. This is in addition to the 1% additional tax demanded by many producer states that have grievances about the new GST as it is a destination based tax.

It is assessed that the 27% rate is one of the highest in the world given the low tax rate on commodities and services.

Destination based nature means the consumption point will be taxed more and thus consumption states will gain more in terms of revenue collection.

Understandably, the GST seems to give less space for states to flexibly change tax rate.

An outstanding novelty of the new tax regime is the creation of a constitutional mechanism called GST Council to determine tax rate for the different goods on behalf of the states.

The GST Council will be a body of central and state governments. The union finance minister will be the Chairman of the Council.

The GST Council is established as a constitutional body by inserting 279A in the constitution.

Similarly, on the tax power front, Article 246 A is created to specify the legislative power for centre and states to make legislations on GST.

Now, with the passing of the GST, the centre’s tax is Central Goods and Service Tax (CGST), whereas that of the states is State Goods and Service Tax (SGST).