In the government budget, everything is recorded under two heads- receipts and expenditure. Both will be equal for the central government budget. The basic principle in budget making is that to finance the expenditure of the government, there should be enough receipts.

Regarding receipts, all the receipts are not tax revenues or non-tax revenues. Rather, a part of the receipts is obtained through borrowing or debt (described as fiscal deficit). Now, an important implication of the debt receipts (borrowing) is that it produces interest payment expenditure in the future and besides that, the borrowed money should be repaid.

What is debt and non-debt receipts?

Non-debt receipts are the receipts which doesn’t incur any future repayment burden for the government. On the other hand, the debt receipts are those which are to be repaid by the government. Borrowings is the debt receipts. Other receipts in the budget are non-debt receipts.

Why non-debt receipts are desirable?

On the other hand, in the case of non-debt receipts like tax revenues (or tax receipts) obtained by the government is that there is no repayment. Following are the major receipts items in the central government. Debt receipts or borrowing is shown in item number (e). Other items are non-debt receipts.

Table: non-debt and debt receipts of the government

| Source of receipts |

| 1. Non-debt receipts |

| (a). Tax Revenue |

| (b). Non-Tax Revenue |

| (c). Recovery of Loans |

| (d). Other Receipts (disinvestment revenues) |

| 2. Debt receipts |

(e). Borrowings and Other Liabilities |

| Total Receipts (1+2) |

The non-debt receipts have tremendous importance for the central government in terms of their desirability. Most important feature is that they don’t have any debt or repayment impact. So, from the fiscal sustainability angle, high and increasing share of the non-dent receipts is highly desirable. For the central government, following are the m main receipts items.

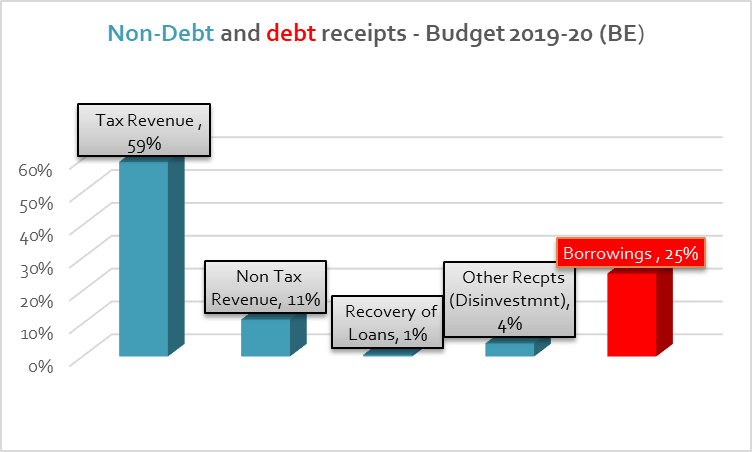

Table: Non-debt and debt receipts as per 2019-20 budget (BE)

| Source of receipts | Amount in Rs crores | Percentage of the total receipts |

| 1. Non-debt receipts | ||

| (a). Tax Revenue | 1649582 | 59 |

| (b). Non-Tax Revenue | 313179 | 11 |

| (c). Recovery of Loans | 14828 | 1 |

| (d). Other Receipts | 105000 | 4 |

| 2. Debt receipts | ||

(e). Borrowings and Other Liabilities |

703760 |

25 |

| Total Receipts (1+4) | 2786349 | 100 |

Figure: debt and non-debt receipts of the government – Budget 2019-20 (July)

Nearly 75% of the total budget receipts are non-debt receipts. Of these, the share of tax revenue to total receipt is 59%. Understandably, tax revenue is the largest receipt item for the government. Among non-debt receipts, the second most important component is non-tax revenues. These are mainly profit of PSEs.

Table: the main non-tax revenues of the centre

| Non- tax revenues – 2019 Budget | ||

| Sl No. | Non-tax revenue item | (Rs crores) |

| 1 | Interest Dividends and Profits | 177239 |

| 2 | Fiscal Services | 425 |

| 3 | General Services | 23449 |

| 4 | Social and Community services | 4180 |

| 5 | Economic Services (including zero net railway revenue) | 104729 |

| 6 | Grants in aid and contribution | 1006 |

| 7 | Non-tax revenue from UTs | 2149 |

| Total | 313179 | |

Debt receipts – the role of borrowings

The second largest item is borrowing which is around 25% of the total government receipts. The implication is that nearly 25% of the government expenditure is financed through borrowing. So, it produces interest payment obligations for the future besides the principal repayment burden. For a long time, the government was financing a considerable portion of the budget expenditure through borrowing. As a result, interest payment became the largest expenditure item for the government now. A reduction in debt receipt or borrowing (or fiscal deficit) is the big step for the government’s fiscal health.

*** *** ***