The RBI’s monetary policy tool kit that includes the instruments like repo, LAF often undergoes change. With time and finacnial sector developments new instruments may come. One such newly inducted instrument is the monetary policy corridor. As the name suggests, it indicate an area between two rates of the RBI’s monetary policy.

The Corridor in the monetary policy of the RBI refers to the area between the Marginal Standing Facility Rate which is the emergency lending rate and the Standing Deposit Facility (SDF) rate which is the liquidity absorption rate. The significance of the corridor is that ideally, the call rate should travel between the corridor, and this shows a comfortable liquidity situation in the system. Previously, the corridor had the upper ceiling of MSF and the lower ceiling of reverse repo. But after the SDF became the active liquidity absorption instrument, it has been inducted as the lower ceiling replacing the Reverse Repo Rate.

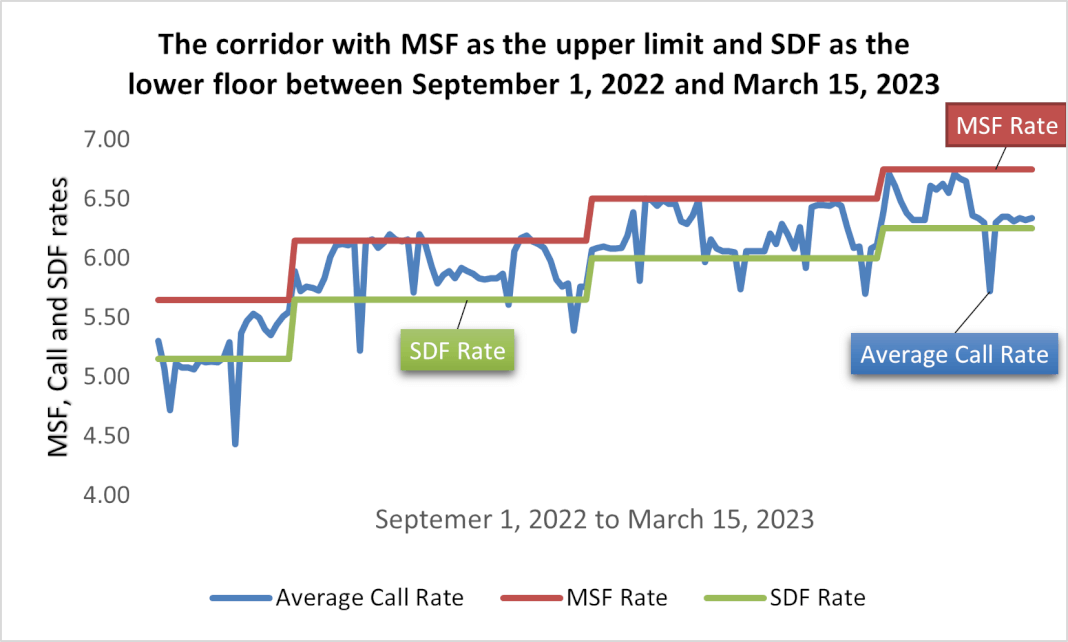

Marginal Standing Facility is the upper ceiling of the Corridor, whereas the Standing Deposit Facility constitutes the lower floor. The call rate should move within the corridor to indicate comfortable liquidity situation in the financial system. The repo rate is usually placed in the middle of the corridor.

Regarding the upper and lower floors, it is to be remembered that the MSF is a liquidity injection facility of the RBI whereas the SDF is a liquiddity absorption facility (collateral free).

The corridor structure for the policy rate is a helping guide for the RBI to design its monetary policy operations. Corridor shows the position of the call rate, which is the operating target of monetary policy. As far as the call rate lies within the corridor, there is not much liquidity disturbance in the system.

Corridor and its monetary policy significance.

As per the monetary policy of the RBI, ideally, the call rate should travel within the corridor showing a comfortable liquidity situation in the financial system and economy.

The corridor structure for the policy rate is a helping guide for the RBI to design its monetary policy operations. Call money rate is the operating target of monetary policy. As far as the call rate lies within the corridor, there is not much liquidity disturbance in the system.

Figure: The Monetary Policy Corridor

The position of call rate is a suitable guide in designing the RBI’s liquidity stabilization response.

The above diagram shows the corridor movement from September 1, 2022 and March 15, 2023.

As of June, 2023, the SDF rate is 6.25 % , whereas the MSF rate is 6.75%. Hence, the corridor has a gap of 50 basis points.

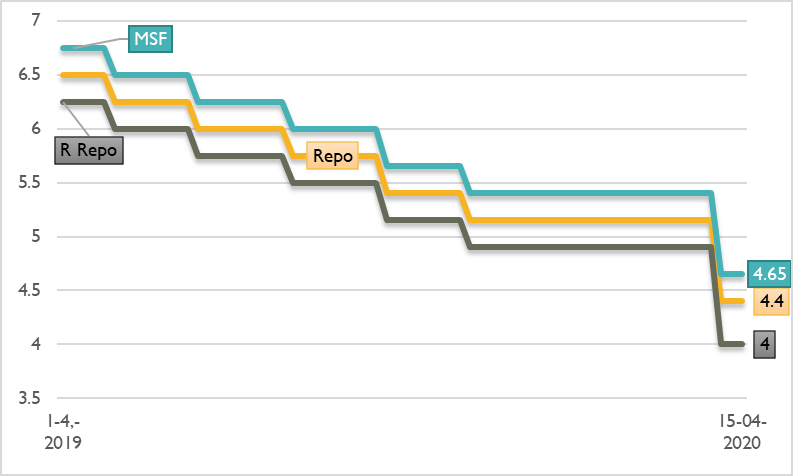

Covid 19 and the unusual situation of asymmetrical corridor

As part of the Covid 19 response package, the RBI brought down the repo rate, reverse repo rate and MSF rates. After this intervention, the corridor width increased to 65 pbs from 50 bps. (During this time, the corridore had upper limit of MSF Rate and the lower limit of Reverse Repo Rate).

On March 27th, 2020, as part of the Covid 19 response package, the RBI reduced the policy rate of repo by 75 basis points from 5.15% to 4.40%.

An even higher reduction in reverse repo rate: The reverse repo rate has a been reduced by 90 basis points to 4 per cent.

The marginal standing facility (MSF) rate reduced to 4.65%.

So, the difference between Reverse repo rate and MSF rate widened from 50 bps to 65 bps.

This widened the gap or corridor between the two rate is quite asymmetrical according to the RBI.

Why the asymmetrical corridor?

During March so far, banks have been parking close to Rs 3 2 lakh crore on a daily average basis under the reverse repo, though the growth of bank credit has been slowing down.

Widening of the Monetary Policy Rate Corridor.

In view of persistent excess liquidity, it has been decided to widen the existing policy rate corridor from 50 bps to 65 bps.