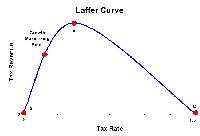

Direct tax reforms in India – spirit of the Laffer curve

Laffer curve shows the relationship between tax rate and tax revenues. It explains how gradual reduction in tax rates from high levels to an optimum rate can maximize tax revenue collection for the government. Laffer curve is mostly applicable in direct taxes like personal income tax.

The working of Laffer curve can be explained with the personal income tax scenario existed in India from early 1970s. In 1972-73, the marginal tax rate (tax rate on the highest income slab) for personal income tax was 97.5 %. This means that a high income group individual will get only Rupees 2.5 out of the additional Rs 100 he earns. Here, there will be no incentive for the individual to work and generate more income. Or, he may try to evade taxes. In both these cases, the government losses tax revenue.

Here if the government reduces the tax rate say to 40% or 30%; it may encourage individuals to work more, generate more income and pay taxes. In this reduced tax rate situation, people finds they get more and should pay less tax. At the same time, tax evasion becomes unprofitable (at low tax rates, tax evasion becomes less rewarding, given its risk). Imagine a tax rate say, 30%; the individual finds that he will get Rs 70 and only Rs 30 should be given as taxes. If the government reduces the tax rate further fromthis optimum, total tax revenue may fall because of reduced rate. This means that there is a right or optimum tax rate, which gives the maximum tax revenue for the government.

The above scenario shows that for a government, if it optimizes the tax rate, it can maximize tax revenue. This message is contained in a simple policy tool called Laffer curve. Laffer curve says that both at zero percent tax rate and 100 per cent tax rate, tax revenue will be zero. At 100 per cent tax rate, all income goes to the government and nobody will work; producing zero income and zero tax revenue. At the optimum tax rate tax revenue can be the maximum. Plotting the Laffer theme into a graph gives an inverted U shaped curve when we express the tax revenue on X axis and tax rate on the Y axis.

Laffer curve is known after economist Arthur Laffer who casually introduced the concept among some policy makers in 1974.

Though simple, Laffer curve is powerful in policy implication. For example, India’s tax reforms from the early 1970s where the marginal tax rate was 97.5%, to 1997-98, where it was brought down to 30%. Over the years, tax collection from personal income tax has improved. This was based on the message of the Laffer curve. Now, the corporate income tax is the largest tax revenue and PIT is the second largest revenue for the centre.

*********